the auto loan companies that are owned by the respective car brand), e.g.:Īfter you've made your first 6 / 12 / 18 payments, your chance to refinance your loan and lower your monthly payments has come. If you bought your car at a Franchise Dealership, you may have qualified for a loan with one of the Captive Finance companies (i.e. Other loans you might have also qualified for could have been with one of the following auto loan companies:

Glassdoor: 3.6 out of 5 stars from 24,901 reviewsĮver wondered if Wells Fargo treats everyone like you? Sadly, they do. Consumeraffairs: 1.4 out of 5 stars from 168 reviews. BBB: 1 out of 5 stars and 3,232 complaints. We looked at reviews for Wells Fargo and found the following: the number 2 goal of a car dealer is to sell the car at the highest possible marginĬonsidering the interests of the car dealer and how most car shoppers get their loans, no wonder Americans are overpaying on their interest rates, right?Īs mentioned above, Wells Fargo is an auto loan and financial services company that specializes on the segment of Americans with good (i.e. the number 1 goal of a car dealer is to sell a car. In fact, the same is true for auto insurance and when you inquire about a warranty. As a result, auto dealers have a leg up when it comes to giving car shoppers loans. People shop for new cars, they don't shop for new loans. ħ9% of all Americans with auto loans get their auto loan at the dealership. The dealer found you your loan and you can make your payments by clicking on WellsFargo Online at. You probably used your used vehicle as a trade-in to lower your down payment. If you currently have a loan with Wells Fargo, you most likely got the loan at the dealership during the car purchase. Our Wells Fargo auto loan calculator can pre-qualify you hassle-free through a simple credit application and help you get a sense for how much you can expect to save from a Wells Fargo auto refinance and the best rates. prime) credit and we observed an average auto loan interest rate of 8% (within a range of +/- 4%), while rates vary a lot by credit score. Wells Fargo targets the segment of American car shoppers with good (i.e. Today, Wells Fargo is a multinational financial services company, still headquartered in San Francisco and the world's fourth-largest bank by market capitalization. Fargo, the two founders of American Express, formed Wells Fargo & Company in 1852 to provide express and banking services to California. How long does Wells Fargo take to repossess my car?īefore going into more detail, here a little background about Wells Fargo: Henry Wells and William G. Best bank for refinancing your Wells Fargo loan?. Can you refinance with the same lender?.

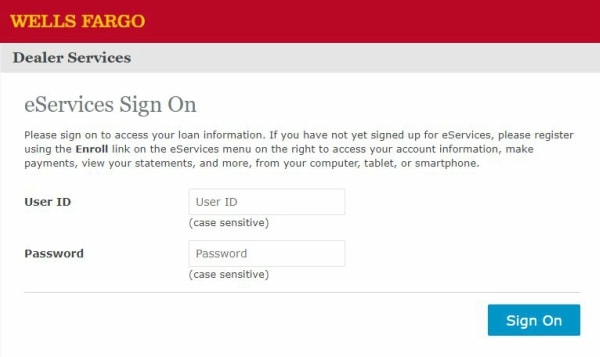

Wells fargo online login auto how to#

How to refinance your Wells Fargo auto loan

Common mistakes people make when refinancing.Does Wells Fargo report to the credit bureaus?īefore refinancing your Wells Fargo auto loan.Instead of making your monthly payment to Wells Fargo why not refinance now and save thousands in minutes. You are a great candidate for refinancing if (a) you got your current loan at the dealership and/or (b) made all of your loan payments on time. You can lower your monthly payments on your Wells Fargo auto loan and save $600 every year / $50 every month through refinancing.

0 kommentar(er)

0 kommentar(er)